Oneir has always provided the option of calculating and displaying finance charges on past due interest charges on your printed statements. These charges, however, were not posted to the customer account receivable ledger or general ledger. This provided a method of informing the customer that there were consequences to late payment of invoices but did not overstate your account receivable for the cases where the finance charges generally were not being paid. Now Oneir provides the ability to accumulate the past due charges on the customer’s accounts receivable ledger. Here is how it works.

Oneir will post finance charges to customer accounts receivable and the general ledger. While Oneir allows you to be selective in it’s posting, i.e. choose one or a range of customers, a particular customer type or a specific customer term, only those customers set up in the accounts receivable with the Statement option, “with finance charge” will reserve the past due interest charges. The calculation is based on the “Term” set up for the customer. See the “Add, update or delete customers?” manual section for these options.

Oneir posts the finance charge on the last day of the month. If the finance charge has been posted for a customer in any given month, Oneir will not post another finance charge unless the finance charge is reversed and finance charge invoice balance is $0.00, for that month. See the Reverse finance charge section later in this section. Therefore, you may post finance charges for one or a group of customers and later posts finance charges in the same month for another customer or group of customers without fear of double posting.

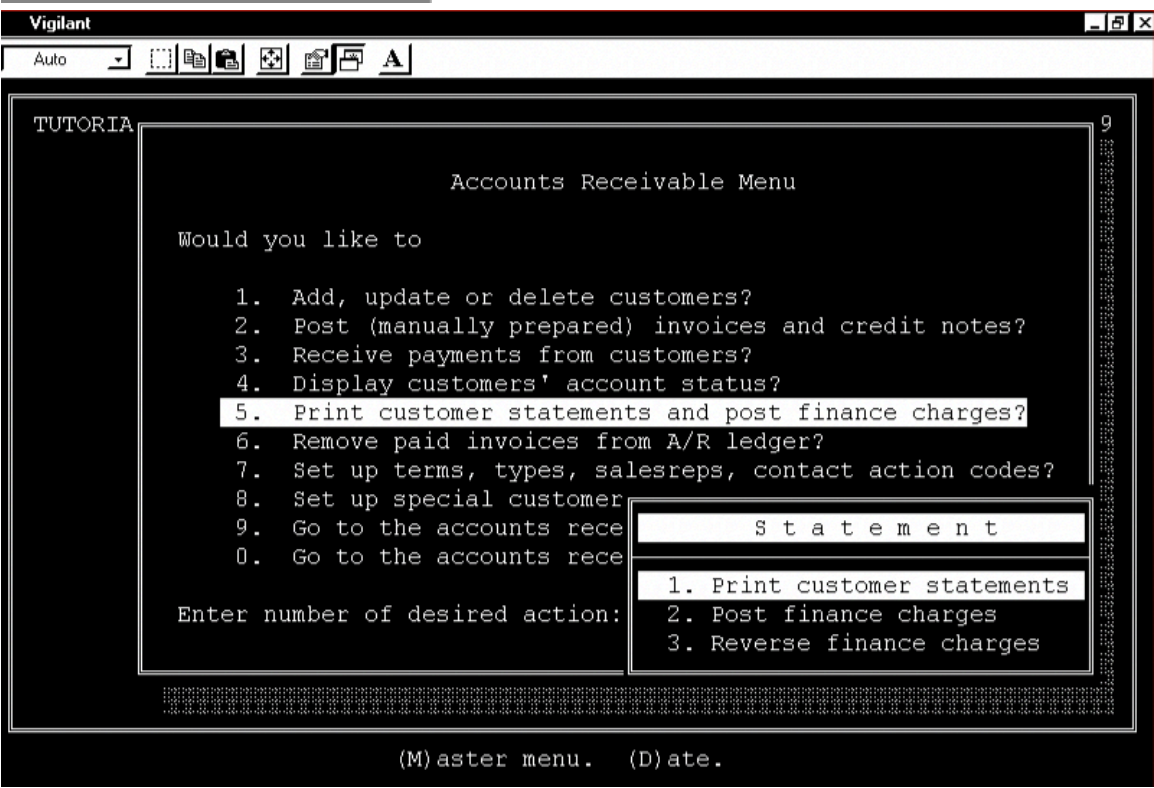

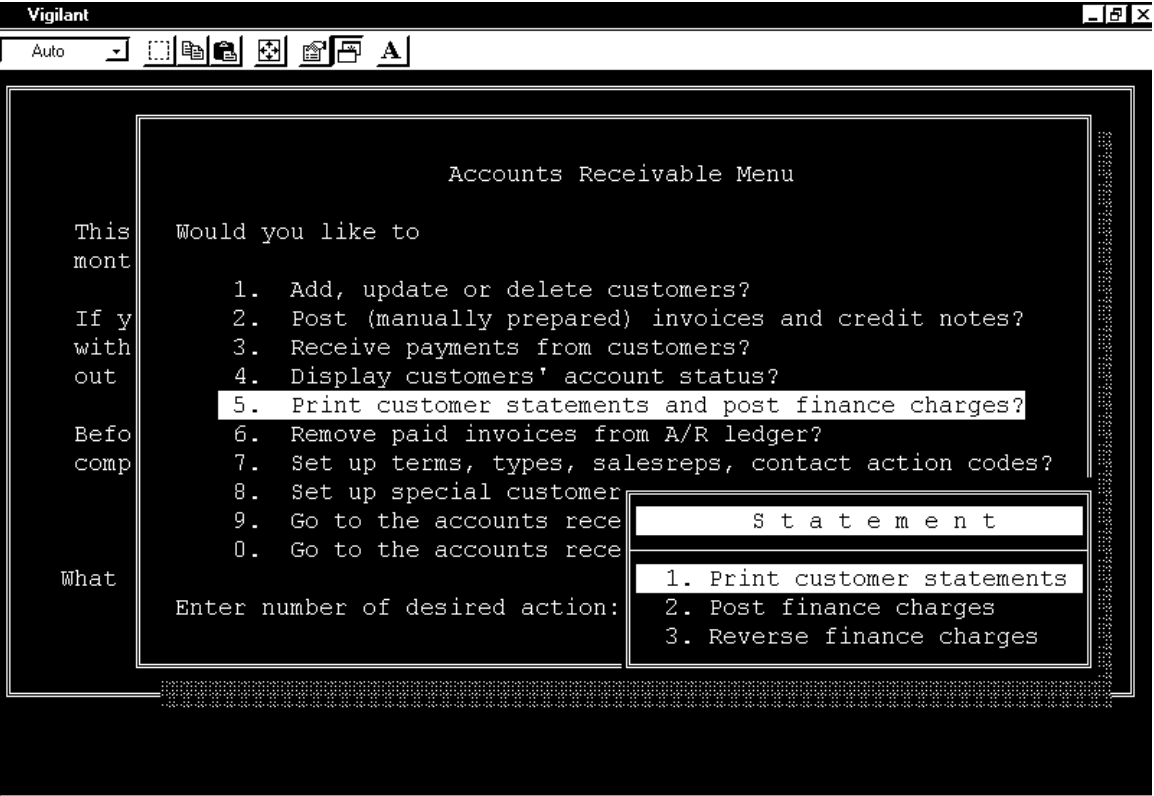

To post finance charges chose option from the accounts receivable menu, “Print customer statements and post finance charges?” Now select option “2” Post finance charges?”

See Figure 1.

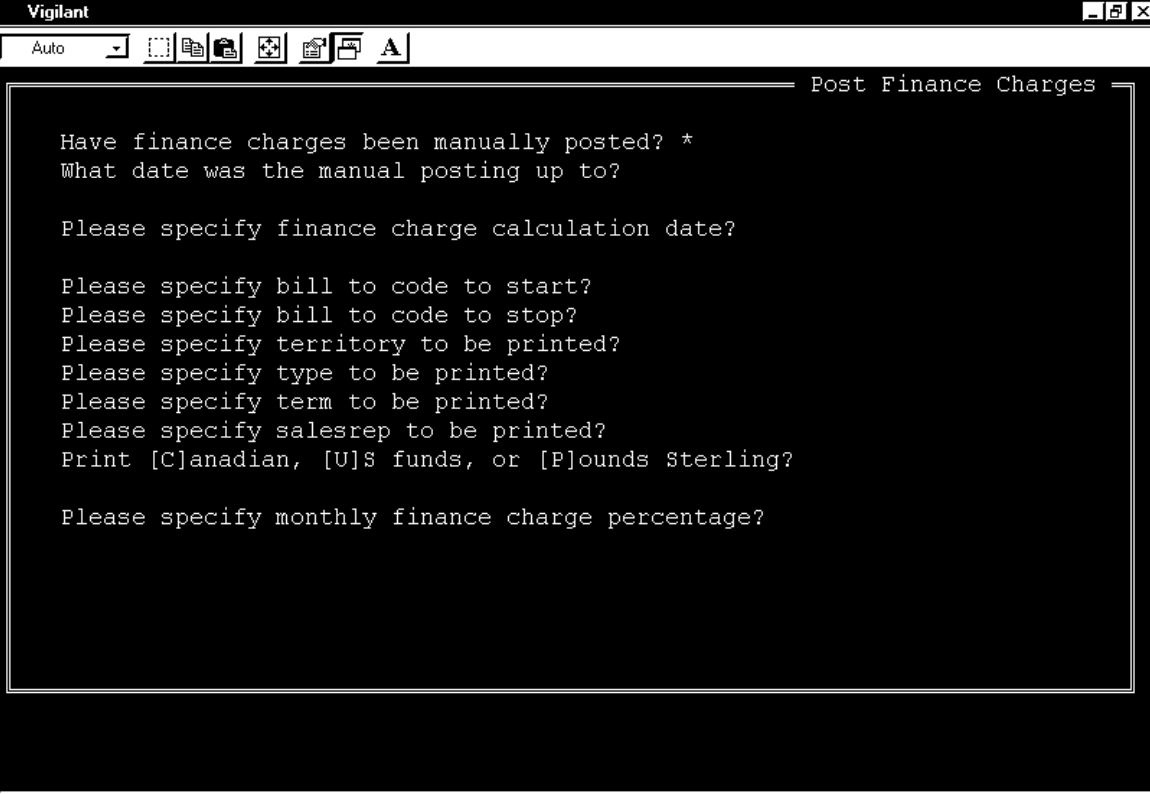

FIRST-TIME POSTING

The first time you enter this menu you are asked, “Have finance charges been posted manually?” If you respond Yes, you are required to enter the last date the finance charges were manually posted. The date entered is the beginning date for which Oneir will start calculating finance charges. Now you are asked, “Please specify finance charge calculation date.” Enter the date up to which the finance charges are to be calculated. This represents the ending date for which Oneir will calculate finance charges. Now that the beginning and ending dates in the finance charge calculation are established, select the appropriate criteria including the percentage rate. See Figure 2.

If you respond No, you are asked, “calculate from Due date or Previous month only?” Select the appropriate option. This date will be used as the beginning date in the finance charge calculation. You are now asked to enter the ending date in the finance charge calculation. Now that the beginning and ending dates in the finance charge calculation are established, select the appropriate criteria including the percentage rate.

Oneir’s finance charge ending data defaults to the previous month end from the date you are logged into Oneir.

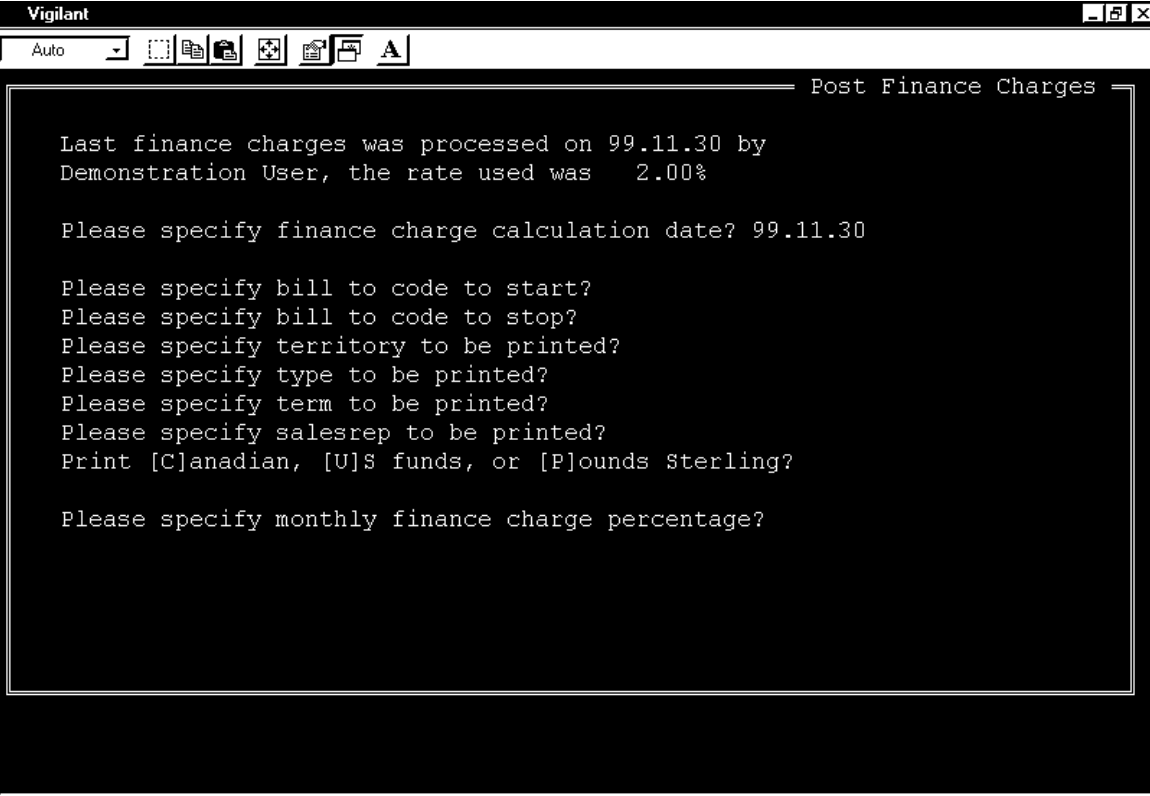

MONTHLY FINANCING CHARGE POSTING PROCEDURES

After a finance charge has been posted once, you are no longer asked about manually posted finance charges. Oneir will display the latest date a finance charge was posted. This date is not used in any calculation. The beginning date of the finance charge calculation is determined by the finance charge invoices posted to the individual customer accounts. The latest date of any ????FC invoice without a $0.00 balance is used as the beginning date in the finance charge calculation. You are asked to, “Please specify finance charge calculation date?” The date entered in used as the ending data in the finance charge calculation and must be the last day of a calendar month. See Figure 3.

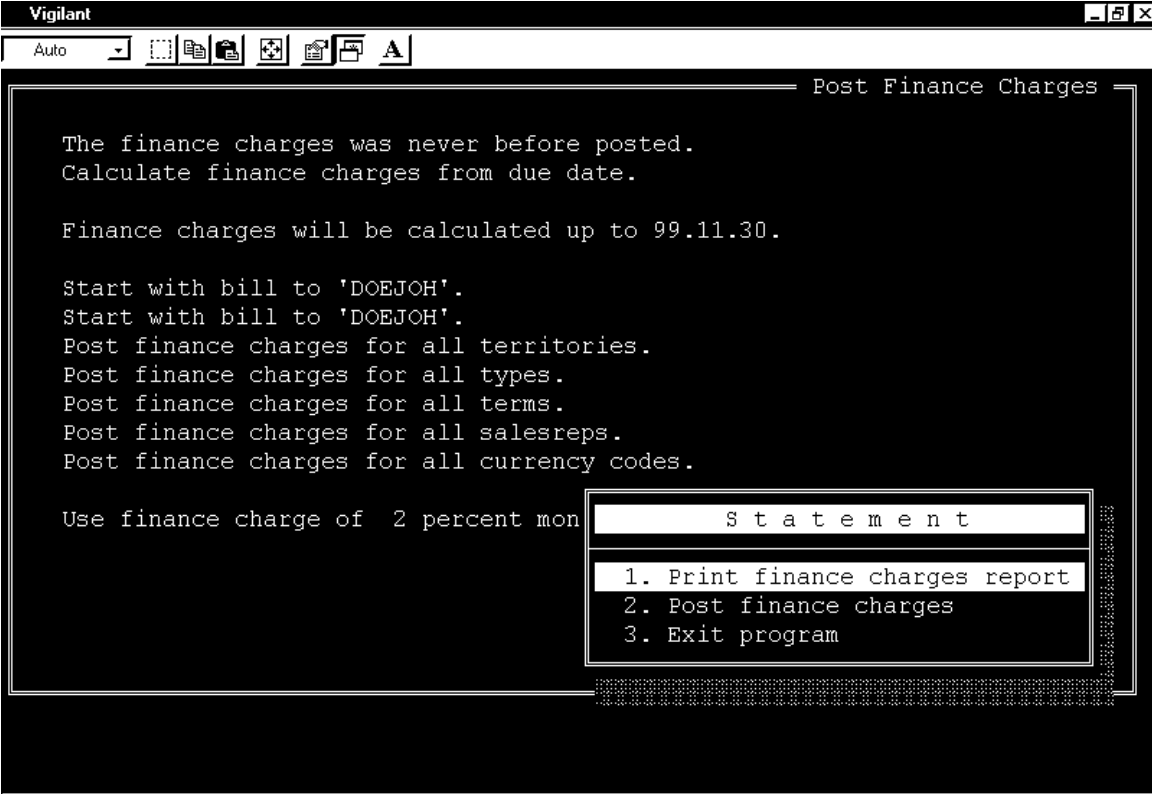

PREVIEW YOUR FINANCE CHARGE POSTING

Before you actually post finance charges to the customer accounts and the general ledger, you are given the option to print a report to view what will be posted with your selections. This report is useful to review finance charges; these will be posted with the criteria you selected. To print the report chose option 1 , “Print finance charges report” and then option 3 “Exit program”. NOTE: YOU MUST CHOSE EXIT PROGRAM BEFORE THE FINANCE CHARES REPORT WILL PRINT. See Figure 4.

HOW ONEIR POSTS?

Oneir creates an invoice to the customer’s account receivable ledger using the format YYMMFC. YY is the year and MM is the month the finance charge is posted in. The FC is a fixed notation provided by Oneir. For example, if you post a finance charge in December 99, the invoice number is 9912FC for each customer who has a posting during the period. See Appendix 2 for sample finance charge accounts receivable ledger posting.

The general ledger posting is made at the same time as the customer account invoice and takes the following form:

DEBIT CREDIT

Account Receivable $XX.XX

Interest Revenue $XX.XX

See Appendix 3 for sample finance charges general ledger posting. The Interest Revenue General Ledger account is selected from the Special Accounts set up in selection 4 of the General Ledger Menu. Oneir uses the account that you set up which corresponds to the “Finance Charges Received” default account in the Special Accounts screen.

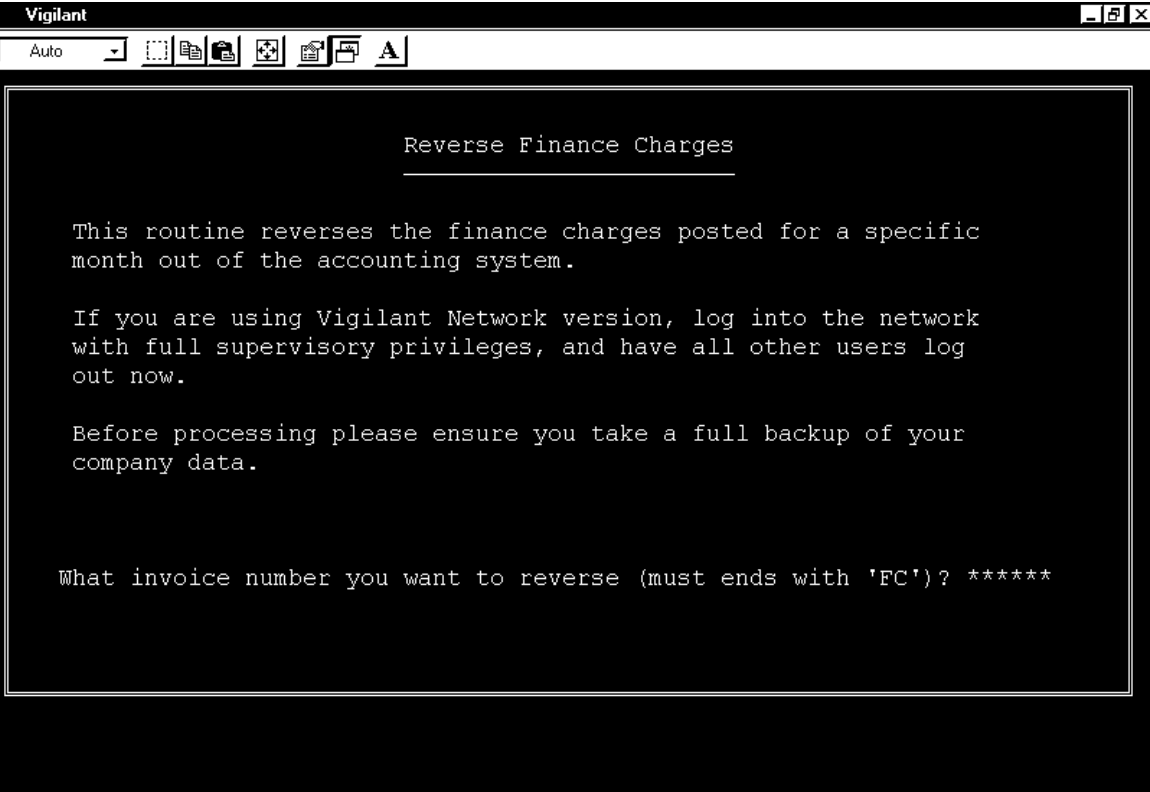

REVERSE FINANCE CHARGE

You may reverse finance charges after they have been posted. To post finance charges chose option 5 from the accounts receivable menu, “Print customer statements and post finance charges?” Now select option 3, “Reverse finance charges?” See Figure 5.

You need simply enter the invoice number you wish to reverse. Oneir will automatically search all finance charge invoices matching the number you entered and reverse the posting in the customer account and general ledger. See Figure 6.

See Appendix 5 for sample finance charges general ledger posting.

WHAT ONEIR POSTS?

Oneir posts a credit note to the finance charge invoice leaving it with a $0.00 balance. See Appendix 4 for sample.

The general ledger posting is made at the same time as the customer account invoice and takes the following form:

DEBIT CREDIT

Interest Revenue $XX.XX

Account Receivable $XX.XX

PRINTING STATEMENTS AFTER POSTING FINANCIAL CHARGES

If you print customer statements after finance charge have been posted; ensure that you chose not to calculate any interest on the customer statement. The finance charge has already been posted and will appear on the customer statement in the form of an invoice.